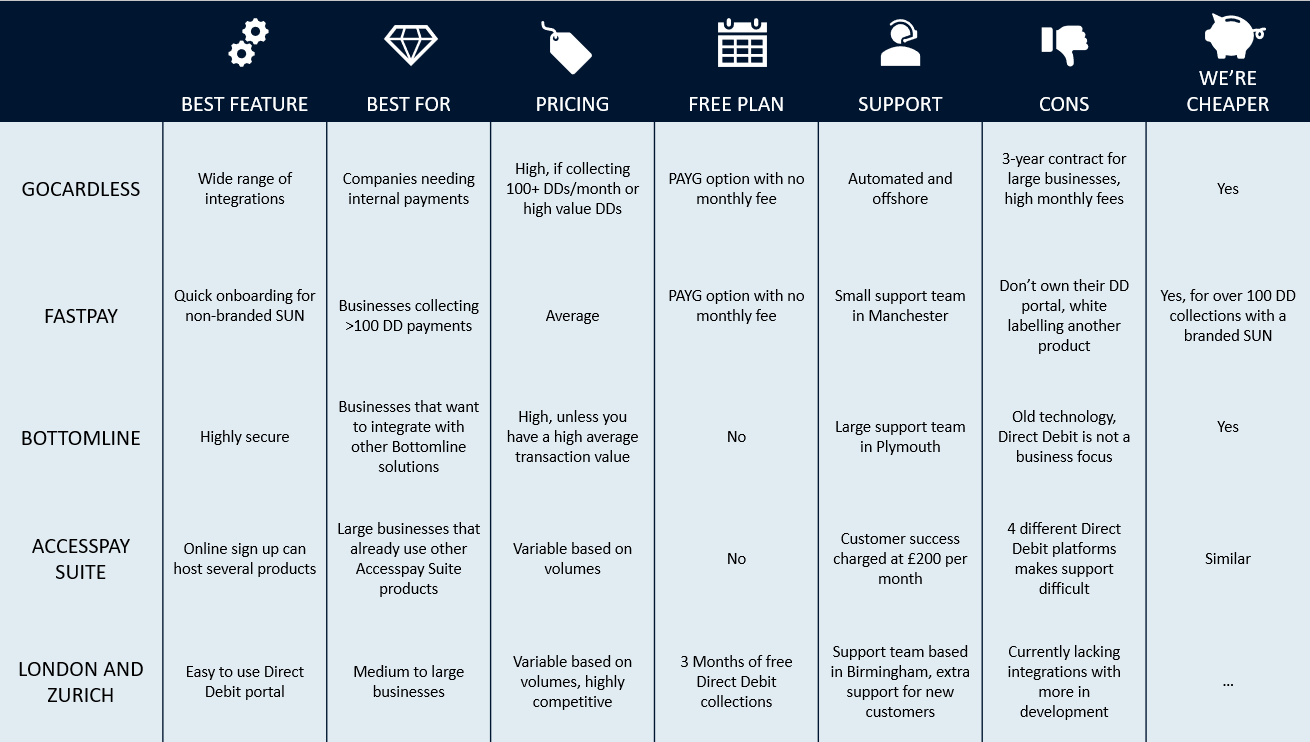

Comparing the best Direct Debit providers

We’re here to help you find the right Direct Debit provider.

Whether you’re a small business seeking cost-effective solutions or searching for the best additional features, this guide will unravel the detail so you can make an informed choice.

To help you find the perfect match , let’s look at the different offerings, fee structures, product features, and additional services:

GoCardless:

Easy integration with various systems, international payments, and user-friendly interface.

Minimum starting price:

£0.20 per transaction, + 1%, up to £200 monthly fee

GoCardless simplifies the process of collecting payments through direct debit, offering businesses a convenient solution for handling transactions. It’s useful for recurring payments or subscription-based services.

Pros:

Gocardless allows for a large number of integrations with their DD system, allowing for most pieces of accounting software to connect. They offer a good price and have a regularly updated DD system that many users love for its simplicity and design.

Cons:

Many customers enjoy their Direct Debit experience with Gocardless. However, there can be issues with their DD system when automated processes lock users out of their account. There has also known to be sudden price increases rolled out to customers after having their account open for a year. Their customer service is also often automated which can make it difficult for some customers to get the help they need quickly.

Clear Direct Debit:

Specialises in direct debit training and consultancy, ensuring compliance and efficiency.

Minimum starting price:

No price advertised, fees arranged on a per-customer basis.

Clear Direct Debit stands out as a provider that offers training and consultancy services to help businesses, particularly in the charity and not-for-profit sectors, manage their direct debit processes effectively. By focusing on compliance, efficiency, and bespoke solutions, Clear Direct Debit aims to assist organisations in navigating the complexities of direct debit transactions

Pros:

Clear Direct Debit have a great training program that they offer with their Direct Debit Bureau service.

Cons:

Fees are arranged on a per-customer basis, with no price offered up-front.

FastPay

Tailored solutions for small and medium-sized businesses, emphasising simplicity and efficiency.

Minimum starting price:

£0.10 per transaction, up to £49 monthly fee

FastPay is a direct debit service provider that caters to SMEs, offering an affordable, easy-to-use platform with a focus on automation, integration, and scalability. Businesses can benefit from efficient payment collection processes without the complexity often associated with larger financial systems.

AccessPaysuite

Provides a secure and scalable direct debit solution with additional features like reconciliation and reporting.

Minimum starting price:

£0.04 per transaction, up to £40 monthly fee

AccessPay provides cloud-based solutions for payments and cash management, offering comprehensive services with a focus on integration, automation, and security. Businesses can benefit from a unified platform that helps streamline financial processes while adhering to compliance standards.

Bottomline Technologies

Offers a variety of financial services, including direct debit solutions for businesses of all sizes.

Minimum starting price:

£0.40 per transaction, up to £50 monthly fee

Bottomline Technologies provides comprehensive financial solutions with a focus on automation, integration, security, and compliance. Businesses can leverage their platform to optimize various aspects of financial management, from payments to cash flow and risk mitigation

Smarterpay

Efficient and reliable Direct Debit solutions, allowing businesses to automate recurring payments

Minimum starting price:

£0.40 per transaction, up to £50 monthly fee

SmarterPay is a UK-based payment service provider that offers various payment solutions for businesses, aiming to simplify payment processes for businesses, allowing them to collect payments from customers through various channels

London & Zurich

Specialises in Direct Debit services with a focus on customer support

Minimum starting price:

£0.20 per transaction or 1% per transaction, up to £29.99 monthly fee

Key features:

- API connectivity

- Live customer support

- Detailed reporting

- Paper and paperless DD

At London & Zurich we specialise in Direct Debit solutions, helping businesses to simplify their payment processes and enhance overall financial management. Our aim is to help you get paid on time so you can take care of running your business, without worrying about late payments.

Our Direct Debit system offers customisation, automation, security, and a user-friendly interface. And it’s easy to set up with us, whether you’re migrating an existing set of Direct Debit customers or getting started with Direct Debit for the first time.

If you want to get a detailed quote, use our Pricing Calculator or Contact Us directly.