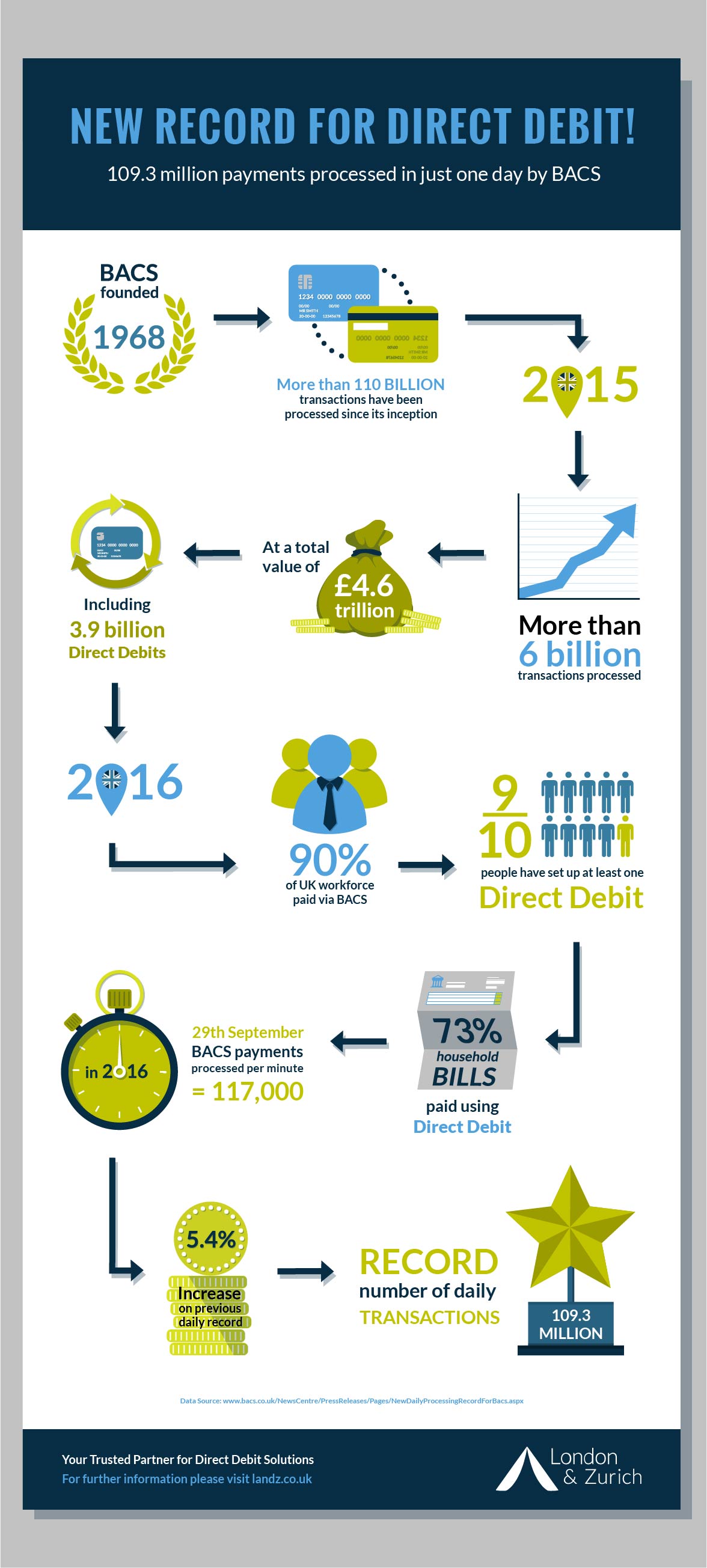

Bacs Payment Schemes Limited (Bacs), formerly known as Bankers’ Automated Clearing Services, was founded in 1968 to facilitate and maintain the integrity of the clearing and settlement of UK automated payment methods – Direct Debit and Bacs Direct Credit. Since then, Bacs has processed more than 110 billion transactions. As a Bacs-approved bureau, we were pleased to hear that last month (29th September to be precise) they smashed their previous record for the number of daily transactions processed. It now stands at a truly impressive 109.3 million daily transactions – that’s 7 million+ per hour or 117,000+ per minute for the 15.5 hours that the processing window was open! The previous record was set on 28th April 2016 at 103.7 million transactions, so the new record marks an increase of 5.4%.

Direct Debit Goes from Strength to Strength

It’s great to see Bacs, and Direct Debit in general, going from strength to strength. In fact, the latest figures show that 9 out of 10 British adults choose to pay at least one regular commitment using Direct Debit (with 73% of household bills being paid this way) and 90% of the UK’s workforce is paid by Bacs. Bacs CEO, Michael Chambers, said: “This new daily record once again underlines the popularity of both Direct Debit and Bacs Direct Credit as payment and collection methods among consumers and businesses.”

2015 – A Memorable Year for Bacs

In 2015, more than 6 billion Bacs transactions were processed for the first time, which included 3.9 billion Direct Debit payments – representing an increase of 6.6% (or 239 million) in 2014. The total value of these transactions exceeded £4.6 trillion!

2016 – More History is Made

We were so impressed by the remarkable records that have been set by Bacs this year, we decided to create an infographic to tell the Direct Debit story visually…

Share this infographic on your site

Please feel free to share this infographic on your website using the code snippet above, and if you have any questions about Direct Debit and how it can improve your organisation’s cash flow, please get in touch with one of our expert consultants today.