We help businesses big and small

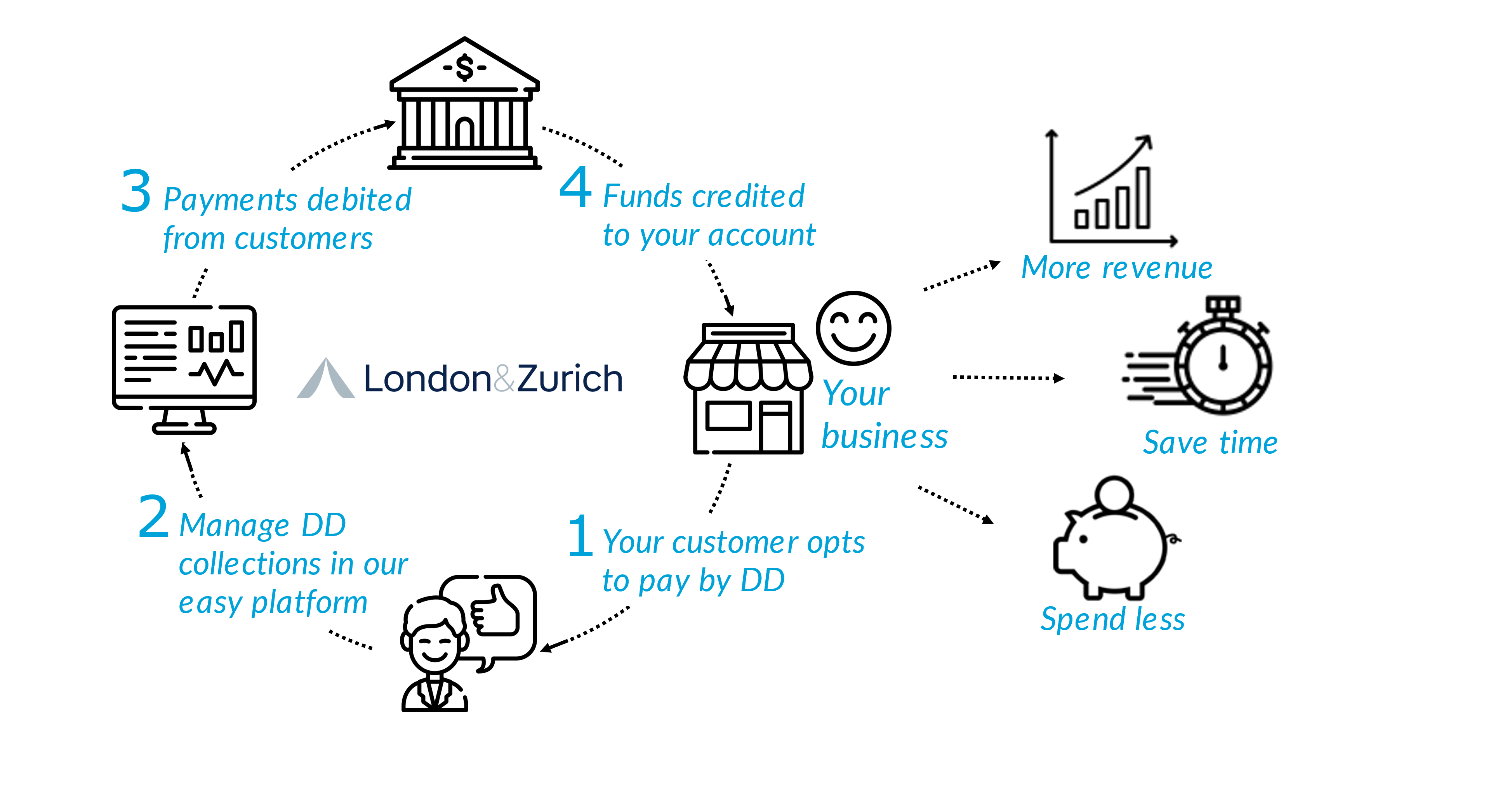

Direct Debit is a simple, cost effective solution to the problem of getting paid on time. Here’s how we can help:

Spend less, collect more

Our easy to use portal makes collecting Direct Debit payments easier, cheaper and faster, with powerful tools including our reporting suite and bulk upload functions.

What is Direct Debit?

A Direct Debit collection is an arrangement made with a bank that allows a third party (London & Zurich) to transfer funds from a customer’s account on an agreed date or ongoing schedule.

The benefits are that you can receive regular payments from your customers, saving everyone time and hassle. Moving to Direct Debit could mean you never have to chase another late payment again.

If you want control over your regular payment collections, and therefore your cash flow, then Direct Debit is the answer.

The benefits of choosing London & Zurich:

Powerful Direct Debit portal

Easily amend payments, check customer details, and get reports to understand your cash flow

Competitive pricing

We will amend your package as your business grows to make sure it stays competitive

Automatic Bacs compliance

Our software sends welcome letters and advance notices to ensure you’re always Bacs compliant

Customised Service User Number

An SUN appears on your customer’s bank statements, so they know exactly who they’re paying

More ways to manage DD

You can manage your transactions through our secure online portal, file uploads, or an API

Personal customer service

We believe having a real person to talk to is always best, and make sure someone is always available to help

4 steps for a fast Direct Debit setup:

Contact us for a quote and a consultation

We create your account and assign a Service User Number

Access training on our Direct Debits portal

Start signing up your customers and collecting payments

How do I apply?

Sales people are here to assist your move to Direct Debits. Complete our pricing form to get an instant quote, and a follow up from a real person – no robots involved!

We’ll help you get on with what you do best – running your business and providing your service – knowing that payments will arrive exactly when they should.

Apply today

Fill out our form

Apply today to get the ball rolling and find the best payment solution for your business.

Apply Today

Switch to us

Whatever your situation, London & Zurich are here to help, switch to us today.

Pricing

Interested? Supply us with a few details for an estimated cost of our services.